Jun. 5, 2019

The Securities and Exchange Commission today sued Kik Interactive Inc. for conducting an illegal $100 million securities offering of digital tokens. The SEC charges that Kik sold the tokens to U.S. investors without registering their offer and sale as required by the U.S. securities laws. As alleged in the SEC’s complaint, Kik had lost money for years on its sole product, an online messaging application, and the company’s management predicted internally that it would run out of money in 2017.

May. 6, 2018

The company recently canceled the public sale piece of its ICO, the Wall Street Journal reported this week, after it raised $1.7 billion from private sale investors, according to SEC filings. But the issues date back further.

Source: techcrunch.com

Apr. 23, 2018

And there’s been a lot of concern that, after their huge ICO fundraises and with no contractual obligation to deliver a product, founders would have little incentive to stick around and do the hard work. But we’re now one year in, and it’s heartening to see that real, meaningful products are shipping.

Source: venturebeat.com

Apr. 13, 2018

The gold-rush mentality currently surrounding the use of initial coin offerings (ICOs) has at times led to projects being used irresponsibly and investors suffering harm as a result. To date, no jurisdiction has provided a bespoke set of legal and technical controls to manage this risk. Instead, some have acted retrospectively by either banning ICOs or applying existing regulatory frameworks relating to other asset classes that are not necessarily compatible.

Apr. 13, 2018

According to Reuters, dozens of people gathered outside the offices of Modern Tech JSC alleging “the largest ever cryptocurrency fraud involving 15 trillion dong,” which works out to more than $650 million USD. According to local news outlet Tuoi Tre News, the protesters allege that Modern Tech defrauded more than 30,000 investors by encouraging them to invest in digital tokens—called IFan and Pincoin—with the promise of regular payouts in real money.

Apr. 4, 2018

On Monday, the US Securities and Exchange Commission (SEC) filed a complaint against the masterminds of an initial coin offering (ICO) promoted by the boxer Floyd Mayweather and producer DJ Khaled, charging them with fraud. The founders were separately arrested and charged by law enforcement.

Source: vice.com

Apr. 4, 2018

The two founders of a cryptocurrency firm called Centra have been charged with with carrying out a fraudulent initial coin offering (ICO) by the Securities and Exchange Commission (SEC). Centra raised $32 million via an ICO which was promoted by boxer Floyd Mayweather.

Sohrab ‘Sam’ Sharma and Robert Farkas, co-founders of Centra were arrested.

Source: cnbc.com

Mar. 31, 2018

The five-year-old company, which has attracted users by touting its encrypted-messaging service, raised $850 million from 94 accredited investors in a Securities and Exchange Commission filing late Thursday. That doubles a previous raise first disclosed in mid-February, adding up to a total of $1.7 billion raised by the firm incorporated in the British Virgin Islands.

Source: fortune.com

Mar. 31, 2018

Consider this a shot across the bow of the entire ICO and blockchain-related sector: email marketing service Mailchimp recently enacted a policy shutting off Blockchain and ICO related accounts. Now, the first victims of this policy are getting the news, and responding in kind by attempting to read the riot act toa Twitter account whose avatar is a monkey with a hat.

Mar. 28, 2018

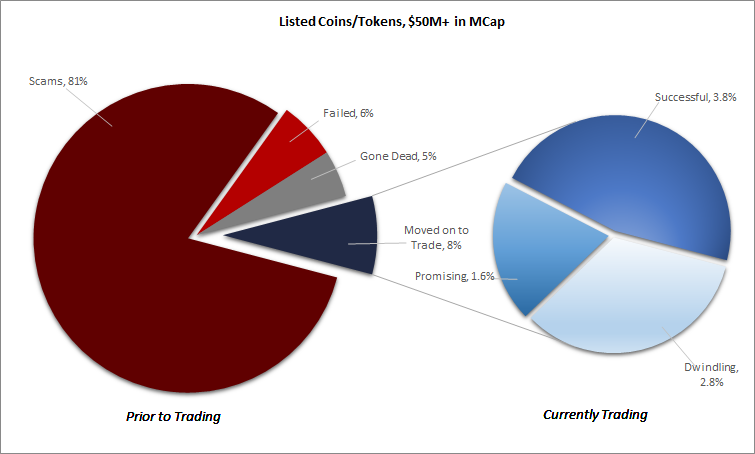

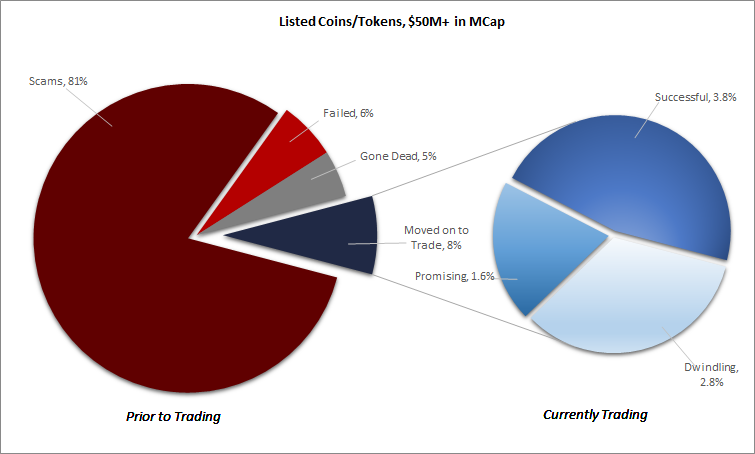

In a recent study, we’ve attempted to classify ICO’s by quality. This encompasses the lifecycle of an ICO, from the original proposal of fundraising availability through to the most mature phase of trading on a cryptocurrency exchange (also known as “online trading platforms”) (“exchange”). This is a high level look above a market cap of $50M only, as an initial attempt to improve on the reporting we have seen to date on percentage failed ICO’s.

Mar. 23, 2018

Regional news sources report South Korea’s financial authorities are working on legislation to formally allow initial coin offerings (ICOs) in an effort to appear more welcoming to the larger financial technology community.

Source: bitcoin.com

Mar. 23, 2018

France plans to create a legal framework for raising funds via cryptocurrencies and aims to become a leading center for offerings in bitcoin-style digital currencies, its finance minister wrote on a news website.

Source: reuters.com

Mar. 8, 2018

Bitcoiin—an Etheruem-based token that is not associated with Bitcoin—markets itself as the “next generation of Bitcoin” and is selling tokens to investors after recently completing an Initial Coin Offering (ICO) that the startup claims raised $75 million USD. “In actuality,” a cease-and-desist order filed on Wednesday by the State of new Jersey Bureau of Securities reads, “Bitcoiin is fraudulently offering unregistered securities in violation of the Securities Law.” Whoops!

Mar. 8, 2018

So in recent months, the SEC has stepped up its enforcement activities, shutting down the most obviously fraudulent ICOs and warning the public that stricter regulations were likely to follow later. Now the feds appear to be getting ready to rein in cryptocurrency exchanges, an important part of the ICO ecosystem that has, until now, operated largely outside of the law.

Mar. 8, 2018

Online trading platforms have become a popular way investors can buy and sell digital assets, including coins and tokens offered and sold in so-called Initial Coin Offerings (‘ICOs’). The platforms often claim to give investors the ability to quickly buy and sell digital assets.

Many of these platforms bring buyers and sellers together in one place and offer investors access to automated systems that display priced orders, execute trades, and provide transaction data.

Mar. 6, 2018

In an attempt to predict startup success from their inception, I and four of my colleagues at NYU developed an AI-powered engine and conducted a digital footprint analysis of more than 6,000 founders using data points such as educational background, employment history, entrepreneurial experience, and personality traits. Based on that training data, our algorithm then predicts how likely a brand new startup is to succeed and gives it a score.

Mar. 3, 2018

The US Securities and Exchange Commission (SEC) has issued ‘dozens’ of subpoenas and information requests from companies seeking to jump on the cryptocurrency craze through Initial Coin Offerings (ICOs).

Source: zdnet.com